Statement of Cash Flows

The Statement of Cash Flows report has always been an important financial report, but has been called different names over the years. It was the "Statement of Changes in Financial Position," "Statement of Sources and Applications of Funds," and "Changes in Working Capital."

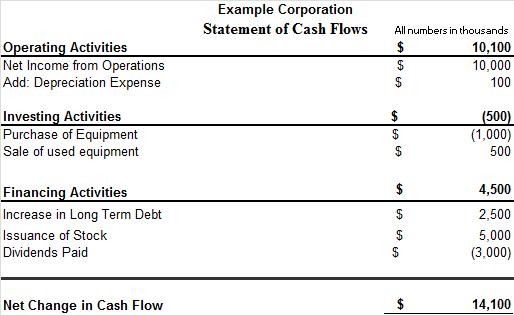

The approach to the Statement of Cash Flows is simple: Report the activities that add to resources of the company and those that subtract from the company's resources. Then, separate cash flow transactions into three buckets: operations, investments, and acquisition or retirement of debt (financing).

In order to understand why the Statement of Cash Flows is important, we need to define the term "working capital" as the difference between current assets and current liabilities. Businesses operate on a cycle designed to generate more working capital in order to grow. For example, cash is used to purchase inventory, inventory is sold at a profit, and thus generates more working capital that could be used for more inventory.

The following are examples of the sources and the uses of working capital (funds):

- Sources:

- Net Income from Operations

- Sale of fixed assets (land, buildings, equipment)

- Acquisition of long term debt

- Sale of stock

- Uses:

- Cash dividends paid

- Purchase of fixed assets

- Reducing or retiring long term debt

- Stock repurchases

When analyzing a company's financial statements, the Statement of Cash Flows provides the reader very valuable information regarding the business; things such as its profitability and the attitudes of management regarding stock sales and issuance of dividends. It can also tell the reader how long term debt is being managed and if reinvestment in capital assets is taking place. This one report can often give an indication of the company’s trend towards general financial strength and how growth is being financed.

The Statement of Cash Flows, like the Income Statement, covers an operating period, in contrast with the Balance Sheet which reports as of a certain date. The Statement of Cash Flows explains why the items on the Balance Sheet have changed during the covered period.

The following is an example of a typical Statement of Cash Flows.

by Jim Marconi, 2012

|