Income Statement

The Income Statement is often referred to as an operating statement. It attempts to report all revenues and related expenses over a given accounting period. The Income Statement will report whether the owner’s equity has increased or decreased over that time.

The first step in preparing the Income Statement is to determine what revenue should be reported. Depending on the business, there may be sales of goods or services, rent, interest, dividends, royalties and so on. Revenue should be distinguished from both cash received and income; it is not synonymous with either. Income, as stated above, is determined as the net of revenue against all expenses associated with it. Cash is not always received when revenue is recorded in an accounting transaction.

Under what is known as accrual accounting, revenue is reported in the period in which it is actually earned. What that means is simple, if a widget sale is made on March 31st, but the company is not paid until the 15th of the following month, the revenue is still reported in March. The second part of accrual accounting matches the expenses associated with the revenue earned. For example, if the widget we sold on March 31st above was built in February and was not paid for until April 15th, we would still count the expense against the revenue in March.

The concept of recognizing revenue and matching the associated expenses was designed to “fairly report” for a given time period the earnings of the company. It is this accounting concept that allows readers to know they can rely on the report and that revenue or expenses were not manipulated to over or understate earnings.

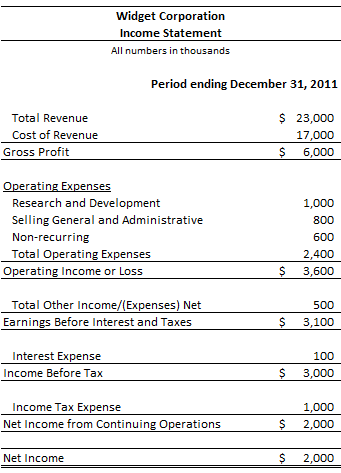

Expenses reported on the Income Statement fall into a variety of categories (see example below). Many businesses want to show the cost of goods sold matched against its sales. Expenses included in the cost of goods sold are, the cost of the product being purchased for resale and the cost to get it to the retail outlet, such as freight. Reported below that then are the operating costs; things such as salaries, supplies, rent, and so on.

Most businesses will have other expenses to report on the income statement that do not involve cash for the period being reported. An example of this is depreciation. Depreciation is the accounting for the loss in value of an asset over an established period of time. If a business purchases a building, for example, the cost of the building is not deducted against the revenue for the period in which it was purchased. Rather, a useful life for the building is established, e.g. twenty years, and each year of operation, the company charges one twentieth of the cost against the revenues earned.

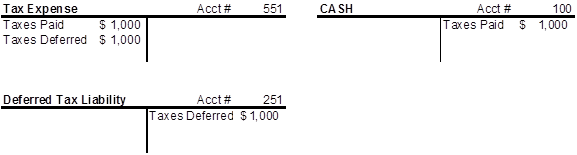

A standard practice is to show Net Profit before Taxes and a separate line for taxes, (see example below). Companies have the option to account for some items differently for tax purposes and accounting purposes. An example would be where the IRS allows an item to be expensed in one year, and the company wants to depreciate the asset over its estimated useful life. For accounting purposes then, the tax would be greater, which would require booking a Deferred Tax Liability.

The following T Accounts illustrate how Deferred Tax Liability would be accounted for:

The following is an example of an Income Statement:

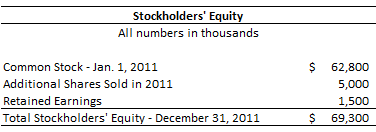

This is an example of the Stockholders' Equity section of the Balance Sheet adding the following:

| Net Income for the year | $2,000 |

| Less Dividends Paid to Stockholders | $500 |

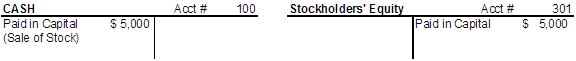

| Additional Stock authorized and sold | $5,000 |

In this example, the company was able to raise $5,000,000 in cash by selling additional stock. The debits and credits to accounts are shown in the T accounts below.

To summarize, the Income Statement summarizes the business operations over a given period of time. The net profit or loss is then added to or subtracted from the equity section of the statement of position or Balance Sheet.

by Jim Marconi, 2012

|