Common Assets on the Balance Sheet

An asset is defined as anything that has value to the business. Assets are reported on the Balance Sheet and are classified as either current assets or non-current assets. Current assets are cash and assets that can typically be converted to cash within one year or operating cycle. Current assets are a component of “working capital" which is the difference between current assets and current liabilities. Non-current assets are assets that are not as liquid and will likely not be converted into cash in the next year.

Under what is known as the “cost principle," assets are reported on the Balance Sheet at cost rather than current value. The accounting principle of conservatism is also a factor in valuing assets: a company should not re-value assets at current market even though they may have greatly appreciated. On the other hand, if an asset has lost significant value compared to its book value, then the asset will generally be written down (and an expense will be booked) in order to align the book or carrying value of the asset with the market value.

When an asset is acquired without a direct cost associated with it, such as in an exchange of property or a gift, the asset is assigned what is know as its “basis" for book and tax purposes. The asset’s basis is recorded at “fair market value" which is determined using the best objective data available at time of acquisition. An example of this would be an appraisal of the property by an independent expert party.

Examples of Assets

Cash

Cash is generally the first asset reported on the Balance Sheet, so it is listed at the top of the current assets section. The value of cash and near cash assets such as short term investments can easily be determined. Cash typically has the greatest controls on it because of its liquidity and susceptibility to fraud and theft. In every company there should be strong controls on petty cash and cash in registers. Employees will reconcile cash balances as often as internal procedures dictate. This may be once a day, or in high volume cash sales environment, as often as every couple hours.

Cash in bank accounts will be reconciled with regular bank statements to ensure that balances reported are accurate. Good internal control over cash will separate the function of reconciling the bank account from the person(s) responsible for writing checks and making deposits.

Accounts Receivable

Accounts receivable is another current asset that is reported on the Balance Sheet when making sales on credit. Essentially, the company makes a short term loan to its customers to get the sale. Typical accounts receivables are due to be paid in thirty days before finance charges are assessed. Well managed companies pay close attention to accounts receivable and their age. Companies “age" receivables in categories such as 1 to 30 days, 31 to 60 days, 61 to 90 days, and over 90 days.

A good business analysis data point is how fast receivables can be turned into cash. A company will strive to keep the largest portion in the 30 day or less category. They may offer discounts to customers for paying within the first thirty days.

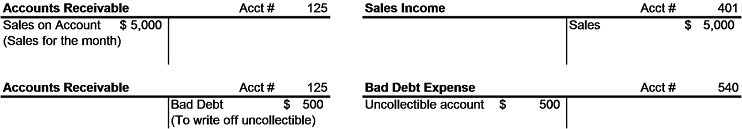

Any time a company extends credit to customers, it can expect that some will not pay. Companies will record “bad debts" by writing off an account receivable. This is done typically when the company first knows it will not be paid. This does not mean it does not still pursue collection. If the receivable or some portion of it is collected in the future, the entry is reversed. See the T-account example below.

Prepaid Items

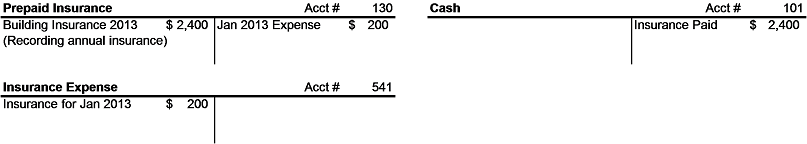

Prepaid items are also shown in the current asset section of the Balance Sheet. Prepaid items such as prepaid insurance are reported as part of an accrual expense matching entry. For example, when annual insurance bills are paid in advance, a book entry is made each month to expense that portion of the prepaid insurance. See the following example.

Inventory

Inventory is a very important component of the company’s Balance Sheet. It may also be one of the company’s largest assets depending on the type of business it is in. Consider the Ford Motor Company, for example. Ford will report as part of its inventory, parts on hand to build cars as well as the finished vehicles. Business analysts will look at how quickly inventory turns over as well as how much is on hand to determine the health of the business.

When inventory consists of a large number of component parts that are for the most part indistinguishable from each other, and the cost to individually account for the items is greater than the item itself, the business may elect to value its inventory using a technique rather than actual cost of the goods in inventory. An example of this would be pipes in a plumbing supply business.

In the first method, the company may match the cost of the inventory sold by the “first in first out" (FIFO) method. This assumes that we sell our oldest stock first and match its cost against the sale. In the second method, the company may match the cost of the inventory sold by the “last in first out" (LIFO) method. This assumes that we sell our newest stock first and match its cost against the sale. In the third method, the company may match the cost of the inventory sold by the “weighted average" method. This assumes that we pool the cost of inventory, using units times cost and match the average cost against the sale.

Intangible Assets

Intangible assets are defined as those assets that have no physical properties, but have value to the business. One example of this type of asset includes “goodwill." Goodwill is the amount of cash that is paid for an ongoing business above the market value of the physical assets acquired, such as in the purchase of a legal practice. Intangible assets are reported on the Balance Sheet at a value that is determined typically as part of a negotiation. Other examples include patents, trademarks, and license agreements. A company may amortize (expense) the cost of these assets over its useful or legal life.

Fixed Assets

Fixed assets typically include longer-life assets such as property, buildings, and equipment.

Companies typically establish what are known as capitalization policies that dictate which purchases are recorded as capital assets and depreciated over time, and those that are expensed in the year of their purchase. The policies usually include things like: cost over a threshold dollar amount, an estimated useful life of greater than one year, and taxing and regulatory agency guidelines.

Fixed assets are recorded at cost plus the cost of freight to deliver, installation, and any other cost to make the asset functional for the business. The fixed asset loses value over its useful life and accounting entries are made to reflect the decrease in value. The company will use a method that best matches the revenue produced using the asset.

by Jim Marconi, 2012

|