Common Liabilities on the Balance Sheet

A liability is a financial obligation of a business. Liabilities are reported on the Balance Sheet and are classified as current and long term. Current liabilities will reduce the assets of the company within one year or operating cycle. Current liabilities are a component of “working capital” which is the difference between current assets and current liabilities.

Examples of Current Liabilities

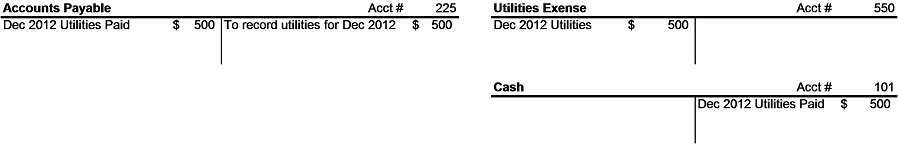

Accounts Payable

Accounts payable are short term obligations of the company arising from transactions that will be completed within the operating cycle. Examples include purchases of goods for resale on credit and ongoing operating expenses like power and water. Companies will often book expenses accrued for the operating period to match the expense with the revenue earned during that same period. See the example below:

Short Term Notes Payable

Companies often require operating cash during down cycle periods. An example would be a short term loan taken by a toy store to purchase goods to be sold during the holiday season. The company expects that a large percentage of its sales will occur during a short timeframe and borrows against those future earnings. Similarly, car dealerships often use what is known as “floorplan" financing. Essentially they acquire short term revolving financing to purchase cars for inventory, and repay as vehicles are sold. These short term notes are booked as current liabilities.

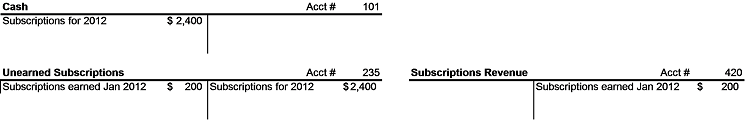

Unearned Income

As the title infers, the Unearned Income liability is booked when cash is received for a sale, but not earned in the current period. An example of this type of revenue is newspaper subscriptions. Customers typically pay in advance for home delivery for months in advance. As the papers are delivered during the subscription period, the entry is booked to add the revenue to sales. This is a liability because the company is obligated to deliver a product or service in future periods. See the example below.

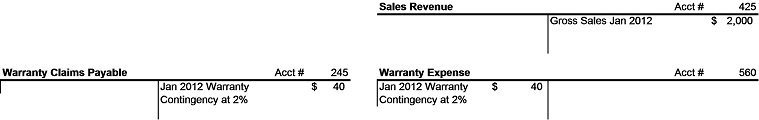

Contingent Liabilities

Contingent liabilities on a company’s Balance Sheet can be ordinary business liabilities such as the amount set aside to cover product warranties. They may also include extraordinary items such as the loss of a lawsuit pending in court. When a company warrants its product, it will typically have a history of the cost to repair or replace the products. An entry will be made to record the expense as a percent of sales.

For those items that are not in the regular course of business, arriving at an amount and deciding when to book the loss is more difficult. For example, accountants will record the liability when a loss from the settlement of a lawsuit is probable and the amount can be estimated.

Examples of Long Term Liabilities

Obligations of a company that extend for more than one year or the operating cycle of the business, are classified as long term liabilities. Examples of long term liabilities include mortgages, bonds, and capital leases.

Bonds Payable

Companies may issue long term bonds to finance growth or expansion of the business as an alternative to issuing stock. They will do this for a variety of reasons. When an investor buys stock in a company, typically voting rights are assigned and some level of control by management is given up. With bonds, no such control is given. Additionally, the company is able to write off interest paid on bonds to reduce taxable income. When dividends are paid on stock issued, they are paid with after tax profits, and thus are double taxed.

by Jim Marconi, 2012

|